Life Insurance in and around Aberdeen

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- South Dakota

- North Dakota

- Minnesota

- Aberdeen

- Oakes

- Ellendale

- Redfield

- Groton

- Webster

- Forbes

- Eureka

- Britton

- Faulkton

- Roscoe

- Huron

- Sisseton

- Selby

- Edgeley

- Warner

- Wolsey

- Ludden

- Ashley

It's Time To Think Life Insurance

People buy life insurance for individual reasons, but the goal is many times the same: to protect the financial future for the ones you hold dear after you're gone.

Get insured for what matters to you

Don't delay your search for Life insurance

Why Aberdeen Chooses State Farm

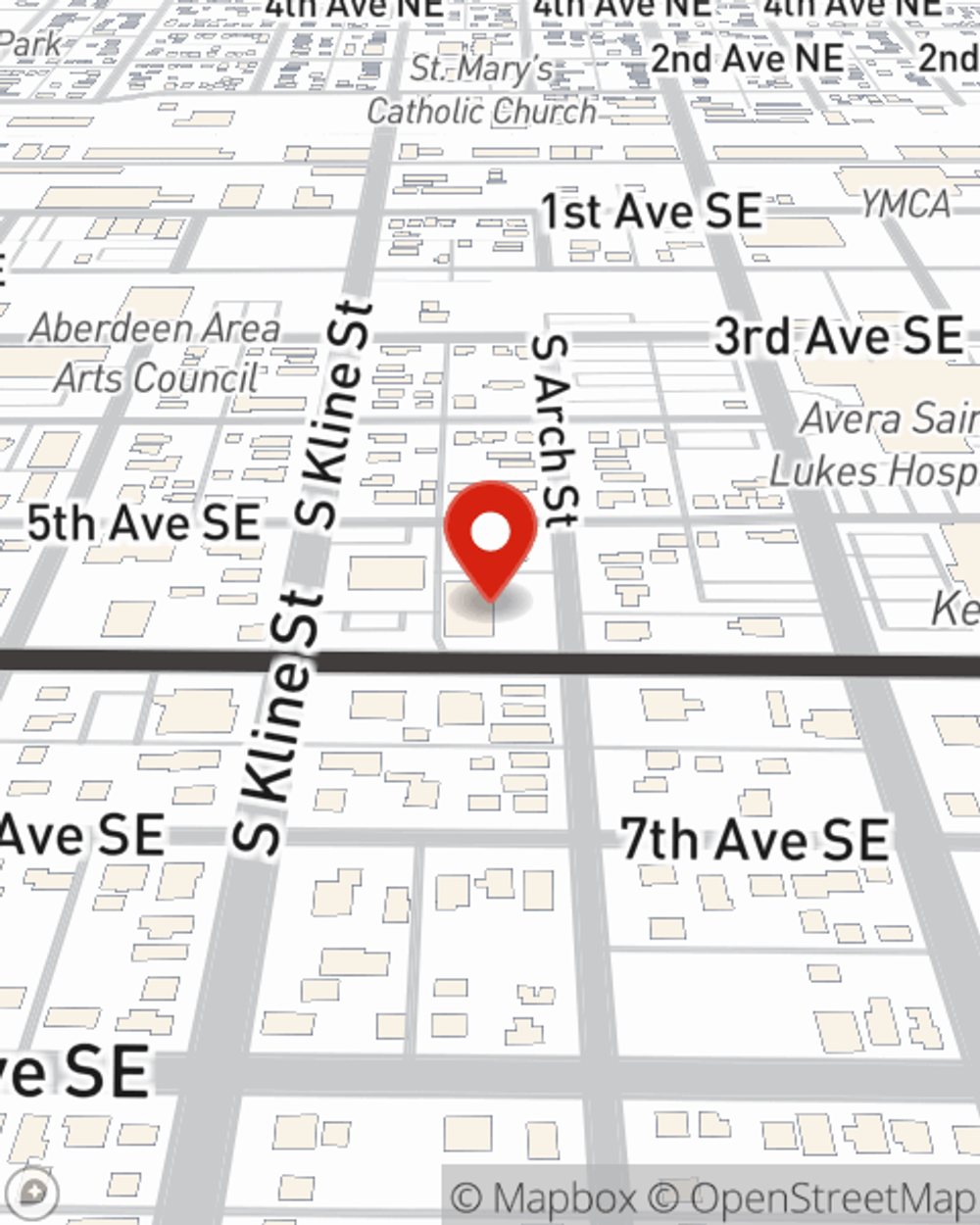

When it comes to opting for what will work for you, State Farm can help. Agent Rob Stiehl can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your age, your health status, and sometimes even family medical history. By being aware of these elements, your agent can help make sure that you get a personalized policy for you and your loved ones based on your unique situation and needs.

Call or email State Farm Agent Rob Stiehl today to see how a State Farm policy can help you rest easy here in Aberdeen, SD.

Have More Questions About Life Insurance?

Call Rob at (605) 824-3372 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.